What Are the Federal Health Insurance Premiums for 2026 USA?

If you’re wondering about federal health insurance premiums 2026 USA, you’re not alone. Millions of Americans rely on federal health plans to protect themselves and their families. Every year, the government updates premiums, coverage options, and subsidy rules, and 2026 is no different. Understanding the changes now can help you plan your budget, choose the right plan, and avoid surprises during enrollment.

How Federal Health Insurance Premiums Are Set

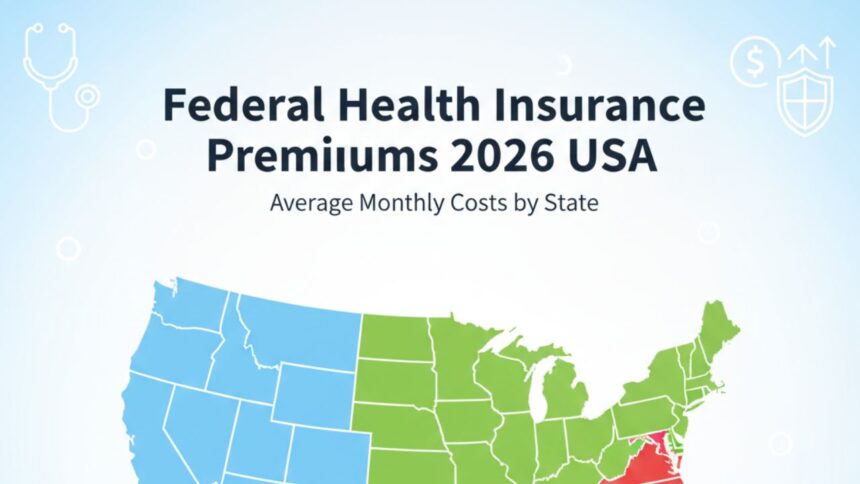

Federal health insurance premiums 2026 USA are influenced by several factors. The federal government works with the Health Insurance Marketplace to set prices based on your location, age, and income. Premiums reflect the cost of medical care, prescription drugs, and administrative fees, which can vary by state and even by county. While premiums may increase slightly in some areas, the federal government continues to provide subsidies for eligible individuals, ensuring that health coverage remains affordable.

Who Is Affected by Federal Health Insurance Premiums 2026 USA

Anyone enrolled in a federal health plan through the Affordable Care Act marketplace will notice the new federal health insurance premiums 2026 USA. This includes individuals, families, and small businesses that participate in federal plans. Subsidies, also called premium tax credits, are available for those with lower incomes, helping offset the cost of coverage. For those who already have federal health insurance, the updated premiums may impact monthly payments, so it’s important to review the numbers carefully before enrollment.

Benefits of Knowing the Premiums Early

Knowing the federal health insurance premiums 2026 USA in advance can help you plan your finances. Early awareness allows you to compare different plans, understand what’s covered, and maximize subsidies if you qualify. In addition, being prepared ensures you don’t miss deadlines for enrollment or subsidy applications. Understanding premiums also helps you make informed choices about deductibles, copayments, and out-of-pocket maximums, ensuring your healthcare coverage meets your needs without straining your budget.

Costs and Pricing Updates

For 2026, federal health insurance premiums 2026 USA are expected to rise modestly in most states. The average premium increase is projected to be around 5%, though this varies depending on local healthcare costs and plan selection. Premiums for high-tier plans, such as gold and platinum coverage, will be higher, but these plans often provide more comprehensive coverage and lower out-of-pocket costs. Individuals and families with incomes under 400% of the federal poverty level may qualify for subsidies, reducing their monthly payments significantly.

Also Read: Will Mortgage Rates Drop in the Next 5 Years? U.S. Forecast

FAQs About Federal Health Insurance Premiums 2026 USA

Q: When do the new federal health insurance premiums 2026 USA take effect?

A: The updated premiums will apply to plans starting January 1, 2026. Enrollment typically begins in November 2025.

Q: How can I lower my federal health insurance premiums 2026 USA?

A: You can lower costs by checking eligibility for subsidies, comparing plan tiers, and considering high-deductible plans if you are generally healthy.

Q: Are premium increases the same in every state?

A: No, federal health insurance premiums 2026 USA vary by state and region, reflecting local healthcare costs and provider networks.

Q: Do these premiums include coverage for prescriptions and doctor visits?

A: Yes, federal health plans cover essential health benefits, including doctor visits, hospital care, preventive services, and prescription drugs.

Q: What happens if I don’t pay my federal health insurance premium?

A: Missing payments can lead to coverage cancellation, so it’s important to pay premiums on time to maintain benefits.

External Links:

Understanding federal health insurance premiums 2026 USA is essential for anyone relying on federal health coverage. By planning ahead, checking subsidy eligibility, and reviewing different plan options, you can ensure affordable and comprehensive healthcare for yourself and your family. Staying informed about these premiums is the first step toward making smart financial and health decisions for 2026.