Student Loan Wage Garnishment Set to Resume in January Under Trump Administration

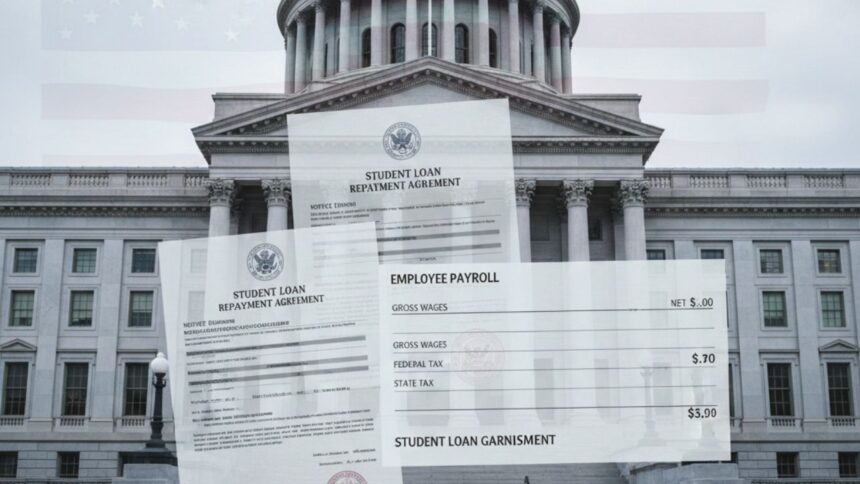

Millions of Americans with defaulted student loans could soon see a portion of their paychecks reduced, as the Trump administration student loan policy moves to restart aggressive debt collection beginning in January. This marks the first major return of student loan wage garnishment since the start of the Covid-19 pandemic, when federal collections were paused.

According to the U.S. Department of Education, administrative wage garnishment notices will begin going out the week of January 7, initially impacting about 1,000 defaulted student loan borrowers. Officials say this is only the beginning, with thousands more expected to receive notices in the following weeks.

What Is Student Loan Wage Garnishment?

Student loan wage garnishment allows the federal government to take money directly from a borrower’s paycheck without a court order. Under federal law, the Education Department can seize up to 15% of a borrower’s after-tax income to recover defaulted federal student loans.

However, protections do exist. Borrowers must still be left with at least $217.50 per week, which equals 30 times the federal minimum wage of $7.25 per hour. Higher education expert Mark Kantrowitz explains that this safeguard is meant to ensure borrowers can meet basic living expenses.

Why Student Loan Garnishment Is Returning Now

During the Covid-19 pandemic, student loan collections were temporarily suspended to protect borrowers during economic uncertainty. That pause has now ended, and the government is moving forward with collections as part of its broader federal student loan enforcement strategy.

The restart comes at a difficult time. Many borrowers are already struggling due to a weaker labor market, frequent changes in student loan repayment programs, and ongoing issues accessing relief options like income-driven repayment plans.

Millions of Borrowers at Risk

The numbers are staggering. More than 5 million student loan borrowers are currently in default, and Education Department officials warn that figure could climb to nearly 10 million borrowers in the near future.

In total, over 42 million Americans have student loans, with outstanding student loan debt exceeding $1.6 trillion. The return of student loan wage garnishment could significantly impact household finances nationwide, especially for lower-income workers.

Other Federal Collection Powers Explained

Wage garnishment is only one tool available to the government. For borrowers with defaulted federal student loans, the government can also:

- Seize federal tax refunds

- Withhold Social Security retirement benefits

- Reduce Social Security disability payments

These powerful tools make federal student loan debt far more difficult to escape than private debt.

Also Read: Very Large Tax Refunds Coming in 2026: Why Americans Could Get $1,000–$2,000 From the IRS

How Borrowers Can Stop Student Loan Wage Garnishment

Consumer advocates urge borrowers to act immediately if they receive a garnishment notice. The most important step is contacting the Default Resolution Group, a federal office that helps borrowers get back into good standing.

One of the most effective options is student loan rehabilitation, which allows borrowers to remove their loans from default by making a series of agreed-upon payments. Other solutions may include consolidation or enrolling in updated repayment plans.

Taking action early can help borrowers avoid student loan wage garnishment, protect their income, and regain access to relief programs.

What This Means for the Future of Student Loans in the USA

The resumption of student loan wage garnishment in 2026 signals a tougher stance on debt collection under the Trump administration student loan framework. As economic pressures continue, experts warn that more Americans may fall into default unless repayment systems become easier to navigate.

For now, borrowers are encouraged to stay informed, respond quickly to notices, and explore all available options to prevent paycheck seizures.

Also Read: DHS Announces Major H-1B Visa Rule Change to Protect American Jobs in 2026